Have you been following the 2021 Medicare Fee Schedule updates? Here is a breakdown of what has happened over the last several months:

- On August 3, 2020, the Centers for Medicare & Medicaid Services (CMS) released a proposed rule relating to the CMS 2021 Physician Fee Schedule.

- On December 1, 2020, CMS issued its final rule that includes updates on policy changes for Medicare payments under the Physician Fee Schedule (PFS), and other Medicare Part B issues, on or after January 1, 2021.

- On December 27, 2020, the Consolidated Appropriations Act, 2021 modified the Calendar year (CY) 2021 Medicare Fee Schedule (MPFS).

- This resulted in CMS issuing an additional update on January 7, 2021 to the Physician Fee Schedule, modifying the changes released on December 1, 2020.

MMG originally published an article shortly after the proposed rule changes were announced. Below is an updated version of that article, which includes the final ruling from CMS.

Per CMS, the calendar year (CY) 2021 PFS final rule is one of several that reflect a broader, Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

Chief among the rule’s proposals is an increase in RVUs – and reimbursement – for primary care services and chronic care disease management. However, to offset the changes to RVUs for these services, the rule also includes a reduction in the payment conversion factor.

With the budget neutrality adjustment to account for changes in relative value units (RVUs), as required by law, the final CY 2021 PFS conversion factor has now been set to $34.89, a decrease of $1.20 from the CY 2020 PFS conversion factor of $36.09. This amounts to a 3.3% overall decrease from CY 2020. The proposed rule released on August 3, 2020 originally decreased the 2021 PFS conversion factor to $32.26 and the update on December 1 slightly increased that proposed conversion factor to $32.41.

There were major factors affecting the increase from the interim proposed CY 2021 PFS conversion factor of $32.26 to the final 2021 PFS conversion factor of $34.89, including:

- Delayed implementation of payment for the complexity add-on code for evaluation and management services, G2211, until CY 2024. The proposed reimbursement for CPT G2211 will now be spread out across all specialties and services rather than going only to primary care and medical specialties.

- Suspended the 2% payment adjustment (sequestration) through March 31, 2021.

- Reinstated the 1.0 floor on the work geographic Practice Cost index through CY 2023.

- $3 billion in additional funding that Congress is adding to Part B payments in CY 2021.

CMS Payments are based on relative value units which are applied to each service for physician work, practice expense, and malpractice. These RVU values become payment rates through the application of the conversion factor. Although the conversion factor will be decreased to $34.89, there are many CPT codes where the increase in RVU value will more than offset the decrease in the payment conversion factor.

The groups who could see the most drastic negative effects will be:

- Groups who reimburse their physicians based on a productivity-based compensation WRVU model (where the providers are paid a certain conversion factor for every WRVU produced)

- Surgical-based specialty groups with high ancillary and procedure volumes

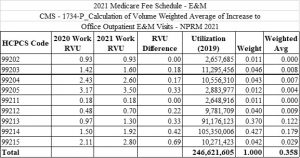

Table A below shows the overall changes to the WRVU values based on the final 2021 Medicare Fee Schedule. These E&M codes are compared to the 2020 WRVU values and their related weighted average differences. The “Utilization 2019” column shows the actual number of new and established outpatient volumes of Medicare patients in CY 2019.

Table A:

As demonstrated by provider feedback, the Medicare Physician Fee Schedule has a wide reach and will significantly impact physician reimbursement. Since most commercial payors’ fee schedules follow Medicare, the changes will likely impact a group’s total reimbursement.

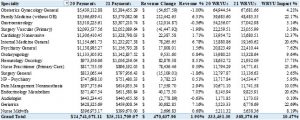

We updated our analysis to incorporate the final rule changes as well as the impact of the Consolidated Appropriations Act to see what the overall impacts could be on our clients who have multiple subspecialties. Our analysis assumed the exact same volume for 2020 and 2021 and shows the reimbursement and RVU impact of the 2021 PFS based on that same volume.

Table B:

As seen in Table B, this group’s overall summary is showing around a 10.5% WRVU impact compared to the 2020 WRVUs. It also is showing that the projected revenue impact, based on these same volumes, will be an increase of 1.9%. There was a wide positive range on the WRVU impact by specialty, while the estimated revenue impact was anywhere between a negative (2%) up to a positive impact of 10%. We believe that this analysis is a good indication of what should be expected if no additional changes are made by CMS in CY 2021.

In summary, it is recommended that, as groups and health systems are putting together or completing their 2021 budgeting, they take a deeper look at the possible impact this could have on their revenue.

We believe there are three potential options to handle these changes in 2021.

- Move forward with the PPRRVU21 table (annually released CMS table with current RVU values) and 2021 PFS reimbursement rates and compensate their physicians based on their current employment contracts.

- Continue to use the PPRRVU20 table when compensating their physicians to remain consistent with the calculated compensation conversion factors in each employment contract.

- Move forward with the updated PPRRVU21 table but adjust their physician compensation conversion factors in order to keep provider compensation similar to CY 2020 and limit the financial impact on the employed groups/systems.

This article and information included in it are for educational purposes only. If you have any specific questions or concerns about the final rule implications as they relate to your group or system’s reimbursement or compensation models, please reach out to Ronnen Isakov at risakov@medicmgmt.com or Anthony Morino at amorino@medicmgmt.com.

Anthony Morino is a Consultant – Analytics with Medic Management Group, LLC. In that capacity, he supports both health system and independent practice clients in generation of actionable data, execution of initiatives based on business analysis, compliance, and reporting. Anthony’s background includes extensive work in areas including data analytics, revenue cycle assessment and execution, information technology solutions, compensation and business asset valuations, patient satisfaction and quality, and business improvement initiatives.

Ronnen Isakov is Managing Director of Advisory Services of Medic Management Group. His background includes extensive work in areas including business advisory, valuation, network optimization, transaction support, and project management. MMG is a national provider of consulting services and back office administrative support to independent and system owned physician practice groups.